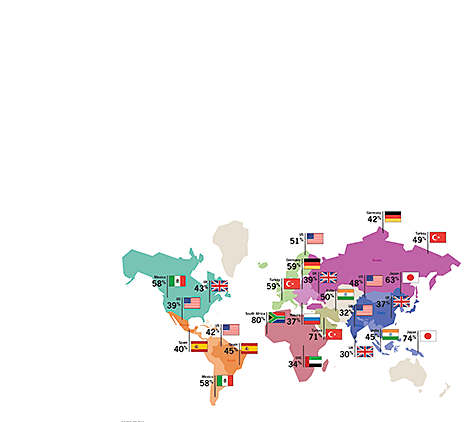

Our annual look at M&A sentiment around the world shows that the shift in acquisitive focus amongst businesses uncovered last year – from domestic to cross-border – is becoming increasingly popular as a key strategy for companies looking to facilitate growth.

Blog

The rise of the cross-border transaction

IBR

Diversity in decision-making

There was much cause for optimism in our annual look at women in business through the International Business Report (IBR). The survey reveals that the proportion of women in senior management roles has climbed to 24% (up from 21% in 2012), back up to levels seen before the financial crisis.

Tax

Transfer pricing news, edition 3

Welcome to the third edition of Transfer Pricing News. This provides updates on transfer pricing developments from a number of countries across the globe – a necessity in the global economy we all now inhabit.

IFRS

Liability or equity?

Classification of a financial instrument as either liability or as equity has an immediate and significant effect on an entity’s reported results and financial position. Liability classification for instance affects an entity’s gearing ratios and typically results in any payments being treated as interest and charged to earnings. This guide addresses the key application issues to consider and includes interpretational guidance in certain problematic areas.

Blog

Doing business in South Africa

The outlook has improved somewhat since the ANC’s Manguang conference at the end of last year. It is encouraging for business leaders to see the adoption of the national development plan, with various measures to tackle unemployment, poverty and inequality.

International Business Report (IBR)

The irony of skills shortages

I confess to being somewhat surprised when I first saw the most recent data from our International Business Report (IBR), revealing that the number one recruitment challenge for business leaders is a lack of key technical skills in candidates.

Blog

What next for the workshop of the world?

On 18 January, the National Bureau of Statistics in China revealed that the economy’s working-age population shrank by 3.45m in 2012.

IFRS

Deferred tax – avoiding the pitfalls

Many companies find the accounting for deferred tax causes significant practical difficulties. This guide summarises the approach required by IAS 12 'Income Taxes' and provides examples of the disclosures required by it. It also looks in detail at some of the more complex areas of preparation of a deferred tax computation, for example the calculation of deferred tax balances arising from business combinations.

Blog

From Grexit to Brixit?

The United Kingdom Prime Minister, David Cameron, today set out a path by which the country could leave the European Union by 2017.

Blog

The outlook for 2013

The big New Year business story was that politicians in the United States had pulled the economy back from the brink of the ‘fiscal cliff’, albeit slightly later than planned.

Tax

Expatriate tax ebook

This Expatriate tax ebook has been designed to provide an overview of the different tax systems around the globe and gives further information about tax systems and regulations in specific countries.

Global Economy

Globalisation tied up with red tape

On the one hand, the results from our once-every-two-years look at the world’s leading emerging markets were encouraging. Business leaders across the world are looking at international expansion opportunities.

Tax

Expatriate tax newsletter, edition 8

Grant Thornton understands that multinational tax challenges are among the most complex and expensive issues facing companies with international operations. And expatriate tax issues are a key consideration for companies working across borders.

Blog

Doing business in Russia

Your questions answered by Nigel Davies, your questions answered by Nigel Davis